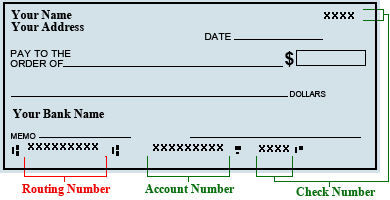

In United States Federal Reserve Banks need routing numbers to process Fedwire funds transfers. The ACH network also needs them to process electronic funds transfers for example direct deposits and bill payments. You can easily find the ABA routing number at the bottom of your checks. The ABA Routing Number is the left-most number, followed by your account number, and then by the check number on the right side.

Each financial institution in US can apply for up to 5 routing numbers. but many institutions have more than 100 routing numbers due to mergers or acquisitions. The banks or credit unions that have multiple routing numbers may use different routing numbers for different purposes. For example, some routing numbers are dedicated for use with Fedwire only, and cannot be used for ACH transfers. Some financial institutions use routing numbers for specific regions or specific types of accounts, such as a business account. A routing number can also be used only for the old accounts of an acquired or merged bank. Its very important to double check and use the correct routing number before making a money transfer. The Routing Number Lookup tool can help verify the Routing Number is associated with a specific financial institution.

TransferWise has super smart technology to transfer money Internationally, which will save your money from abroad transactions as compared to the bank transactions in the older days which charge huge hidden charges and take so many days to transfer money into your account. Do hassle free transactions with TransferWise inorder to have complete funds security and mental satisfaction that your funds will reach destination within stipulated time and have a safe delivery to your accounts. Following are the benefits of doing transactions with TransferWise:

1: Low transaction cost, much cheaper than others

2: Easy and fast money transactions.

3: Secure Bank transactions into your foreign bank accounts

4: More than 50 Currencies supported.

5: Wide network of more than 100 Countries.

6: 10 million happy customers around the globe.

7: 5 star rating and near about million reviews on TrustPilot.

1: Parents transfer University fees, Schooling fees or other expense funds to their kids abroad.

2: Business parties transfer funds to each other.

3: Persons working abroad transfer funds to their parents, relatives or family.

4: Account to Account transfer from one country to other before moving to that country.

5: Online salaries are transferred to employees by companies.

6: Freelancers work money are transferred.

7: Online Fees for any services like Legal, Visa etc.

8: Transfer your funds to family business accounts.

9: Online charities to NGO's.

10: Investors to invest money in foreign currencies.